Gang, just a heads-up – if you have a brokerage account and aren’t fully invested, there’s a “simple and safe” option I use. With ultra-short-term bond ETFs, I can park my cash with minimal risk and still earn around 3–5% annually.

My Problem with Cash

I don’t like keeping money in regular savings accounts where it earns practically nothing while inflation eats away at purchasing power. I needed a better solution.

My Solution: Ultra-Short Bond ETFs

I park my cash in ultra-short-term bond ETFs where I earn around 3–5% annually with minimal risk. These ETFs invest in government or high-quality short-term bonds – I think of them as sophisticated bank deposits with better control and usually superior returns.

Why This Works for My Style

This approach is ideal for my investing style since I don’t want to monitor the market daily but still want my cash working for me. The liquidity is excellent – I can sell and access my funds quickly when I spot a buying opportunity.

My Personal Setup

I keep all my uninvested EUR and USD in these ETFs. When I need funds to buy stocks, I simply sell the ETF shares and make my purchase within hours.

The Tickers I Use (EU Residents)

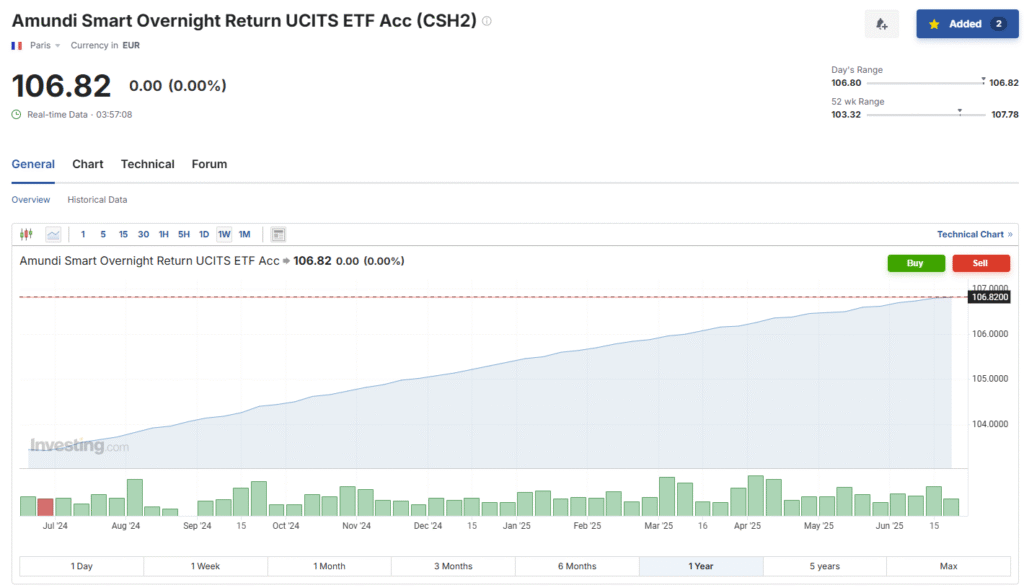

- CSH2 (Euro): Currently yielding around 3.4% annually in my portfolio

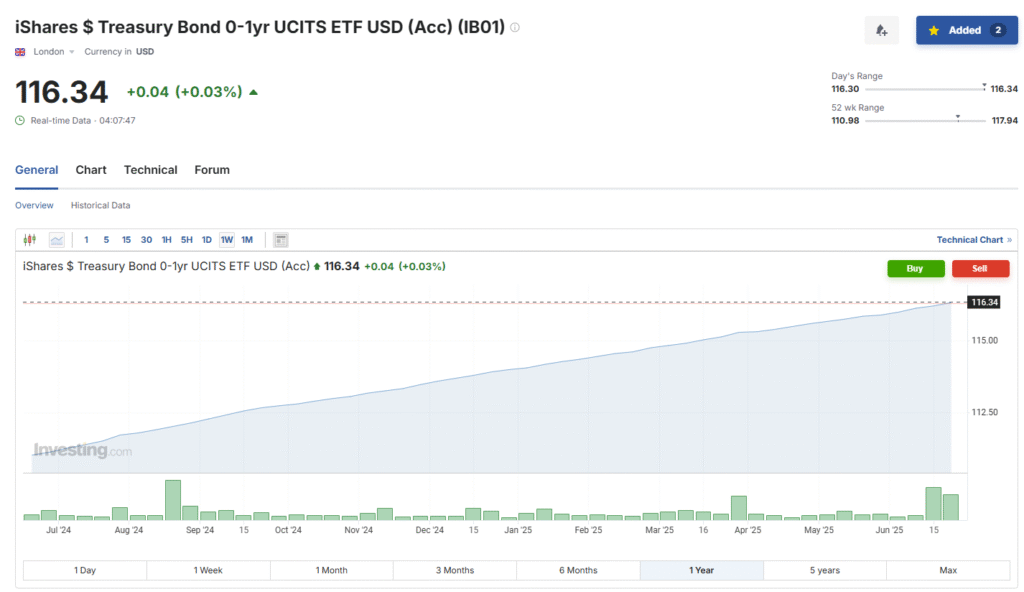

- IB01 (USD): Currently yielding around 4.8% annually in my portfolio

Note: These are the tickers I use as an EU resident. Availability varies by country.

My Experience

This system has worked well for my cash management needs. I get better returns than traditional savings while maintaining the liquidity I need for investment opportunities.

Remember: This is my personal approach to cash management. Always research what works best for your own situation.