Hello gang, I’ve just updated my quality growth watchlist and tightened my screening criteria even further. Here’s what I’m focusing on now and the companies that made the cut.

My Updated Screening Criteria

I’m looking for companies that excel in all these areas:

- Growth in revenue and profit – consistent upward trajectory in both top and bottom line

- Strong balance sheet – at least 2x-3x more assets than liabilities for financial stability

- Low debt burden – ideally no or minimal loans, since interest payments eat into profits

- Tech sector focus – mostly technology companies where I see the strongest long-term trends

- Growing equity – shareholder equity must increase over the years

- Smart dividend policy – if dividends are paid, payout ratio max around 50%

- Growing dividend payments – if the company pays dividends, they should increase over time

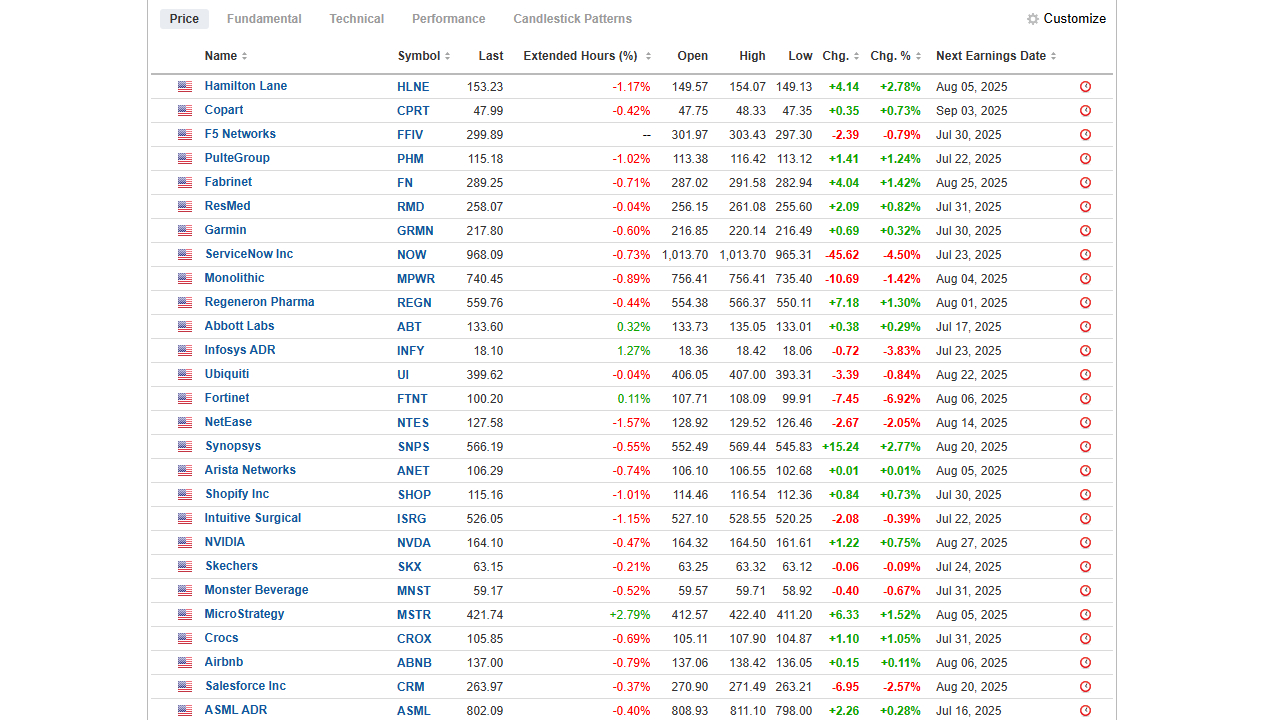

The 40+ Companies That Made My List

Tech Giants & Software

- Alphabet (GOOG)

- Amazon (AMZN)

- Apple (AAPL)

- Meta (META)

- Microsoft (MSFT)

- Adobe (ADBE)

- Salesforce (CRM)

- ServiceNow (NOW)

Semiconductors & Hardware

- NVIDIA (NVDA)

- Taiwan Semiconductor (TSM)

- ASML (ASML)

- Applied Materials (AMAT)

- Lam Research (LRCX)

- Micron (MU)

- Qualcomm (QCOM)

- Texas Instruments (TXN)

- Synopsys (SNPS)

Healthcare & Biotech

- Abbott Labs (ABT)

- Intuitive Surgical (ISRG)

- Regeneron (REGN)

- ResMed (RMD)

Emerging Tech & Fintech

- Coinbase (COIN)

- MicroStrategy (MSTR)

- Shopify (SHOP)

Consumer & Lifestyle

- Airbnb (ABNB)

- Crocs (CROX)

- Monster Beverage (MNST)

- Skechers (SKX)

Other Quality Names

- Arista Networks (ANET)

- Copart (CPRT)

- F5 Networks (FFIV)

- Fabrinet (FN)

- Fortinet (FTNT)

- Garmin (GRMN)

- Infosys (INFY)

- Logitech (LOGI)

- Monolithic Power (MPWR)

- NetEase (NTES)

- Pinterest (PINS)

- PulteGroup (PHM)

- Ubiquiti (UI)

My Thoughts

This isn’t a “buy everything” list – it’s my research starting point. Each of these companies has demonstrated the quality characteristics I value, but timing, valuation, and individual circumstances still matter for any potential purchases.

Some names might surprise you (like Crocs or Skechers), but they’ve consistently delivered on my criteria. Others are obvious quality leaders but may be expensive at current levels.

What’s Next

From this list, I’ll be doing deeper individual analysis on companies that show attractive entry points or compelling recent developments. This is where the real work begins.

Remember: This represents my personal research process and watchlist. Always do your own analysis before making any investment decisions.sions.