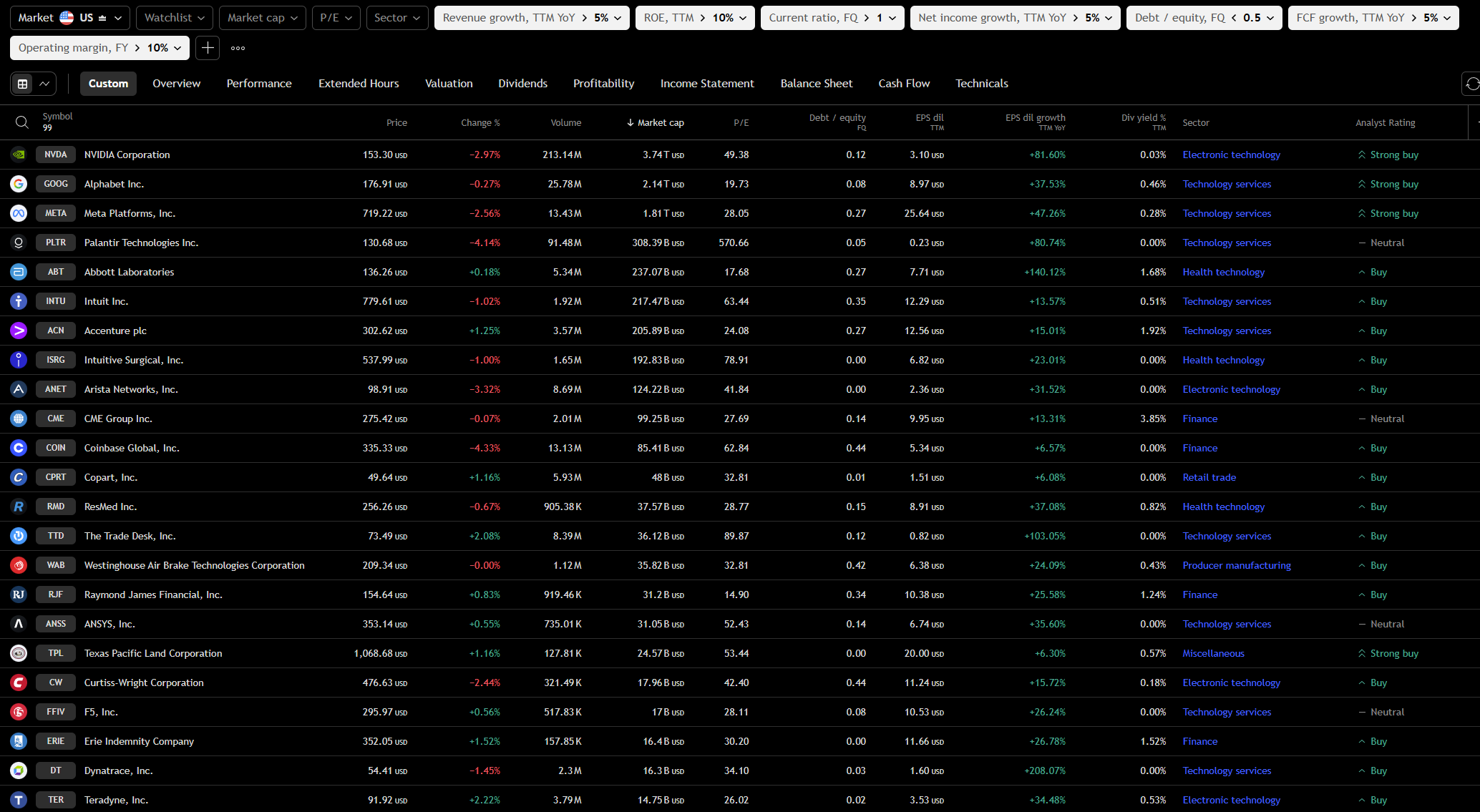

Hey gang, here’s an example of how I approach stock screening. When I’m looking at thousands of companies, I need a systematic filter that eliminates the “junk” – companies I simply don’t want to own.

Depending on my investment philosophy, the filtering method is already the first step toward what I want to achieve in the end. I’m an investor in growing companies that are already generating profit. They shouldn’t be overvalued and must have a strong balance sheet.

So I add these filters to my screener that help me eliminate companies that don’t match my preferences. Then I’m left with companies that are suitable for further analysis.

I have to mention here that not all companies I get after filtering are suitable for purchase. Filtering is just the first step.

Why I Screen First

Without proper filtering, I can waste hours analyzing mediocre companies. A good screening process helps me focus only on companies that are worth my time and money.

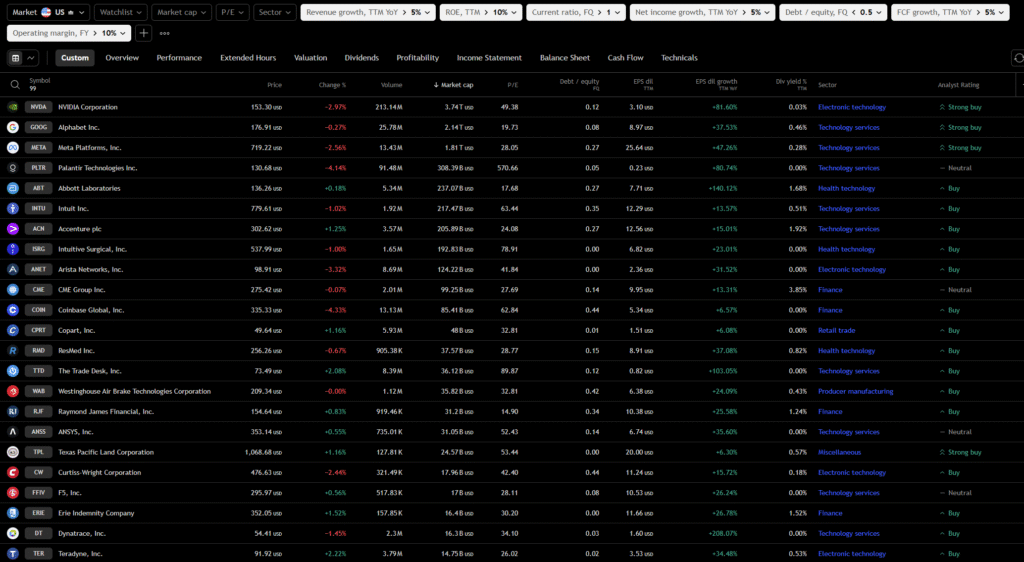

For screening, I use the TradingView platform. There are others available, but this one is closest to my heart.

My Step-by-Step Process in TradingView

- Go to Products → Screener → Stocks

- Click Add New Filters

- Apply my core criteria:

Growth Filters

- Revenue growth: >5%

- Net income growth: >5%

- FCF growth: >5%

Financial Health Filters

- Current ratio: >1 (can pay short-term debts)

- Debt/equity: <0.5 (not overleveraged)

Profitability Filters

- ROE: >10% (efficient use of shareholder equity)

- Operating margin: >10% (strong operational efficiency)

The “Room to Breathe” Philosophy

Here’s a crucial point: I intentionally set conservative thresholds. Revenue growth of 5% isn’t exciting, but if I demand 10%, I might miss an excellent company growing at 9.9%. The goal is to set a wide enough net while still filtering out obvious problems.

What This Filter Achieves

After applying these criteria, I’m left with companies that:

- Are actually growing their business

- Are financially stable

- Aren’t drowning in debt

- Generate solid returns and margins

Next Steps

This is just the beginning. Once I have this filtered list, I can dive deeper into individual company analysis, valuation, and qualitative factors. I’ll be writing about company valuation in upcoming articles.

Pro tip: Save this screener setup in TradingView so you can run it regularly without rebuilding the filters.