Hey, this is a more detailed analysis of Broadcom (AVGO). Broadcom is one of the world’s largest semiconductor (chip) and software manufacturers for data centers, communications, 5G, Wi-Fi, and enterprise storage. Their products are crucial for modern IT infrastructure operations, used by the biggest tech companies like Apple, Google, and Meta.

The company’s main advantages are:

- Exceptionally broad portfolio of hardware and software

- Long-term contracts with major customers, stable revenues

- High margins and strong, growing cash flow

Broadcom also has extensive experience with acquisitions and successful company integration, with the latest major acquisition being VMware.

Broadcom’s main competitors are Nvidia, Intel, Qualcomm, Marvell, AMD, and partially Cisco, primarily in semiconductors and network solutions.

Broadcom Inc. – Brief Profile

- Website: https://www.broadcom.com

- Stock: NASDAQ: AVGO

- Founded: 1961 (as HP Associates; renamed through Avago to Broadcom)

- Headquarters: Stanford Research Park, Palo Alto, California, USA

- Employees: approximately 37,000 (2024)

Analysis conducted on 14.7.2025, data source: roic.ai

Broadcom in Numbers:

1. Growth Potential

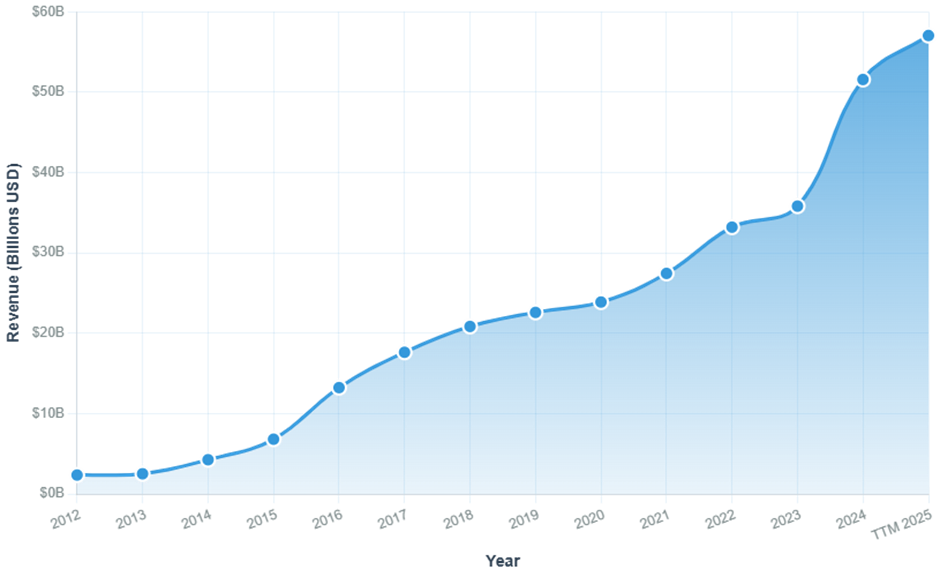

Revenue:

- 2012: $2.36B → TTM: $57.05B

- Very stable growth, acceleration after 2021 due to M&A and AI segment

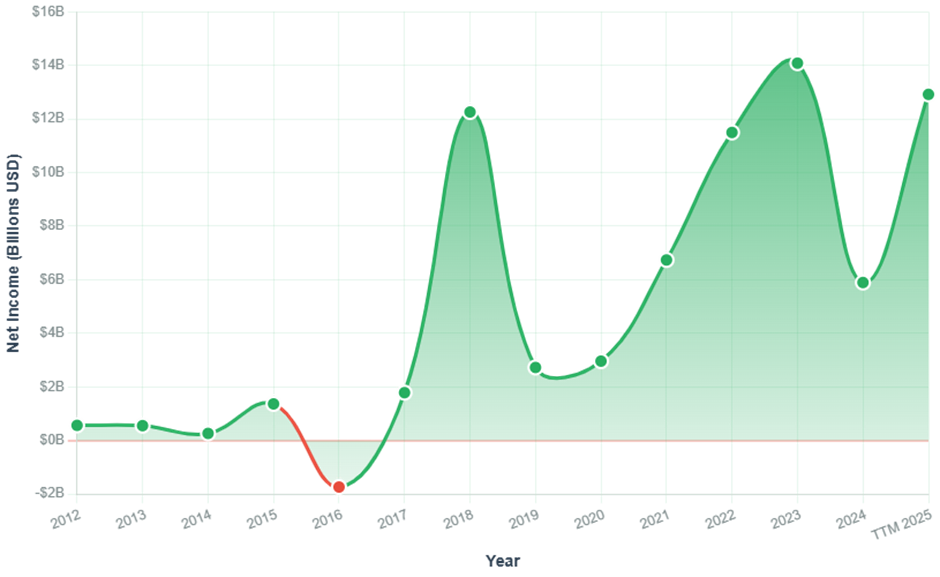

Net Income:

- Growing from $563M (2012) to nearly $13B (TTM). Negative result only in 2016 due to exceptional items (likely acquisition)

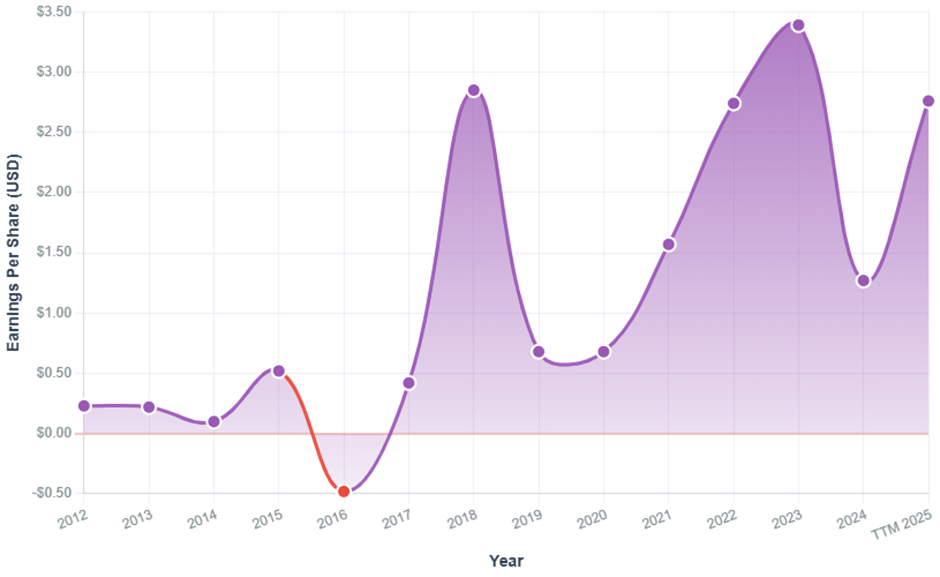

EPS:

- Growing from 0.23 (2012) to 22.76 (TTM)

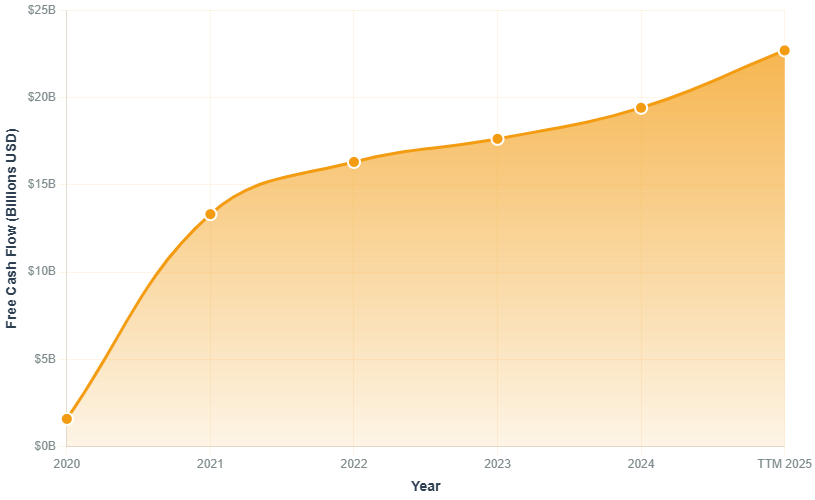

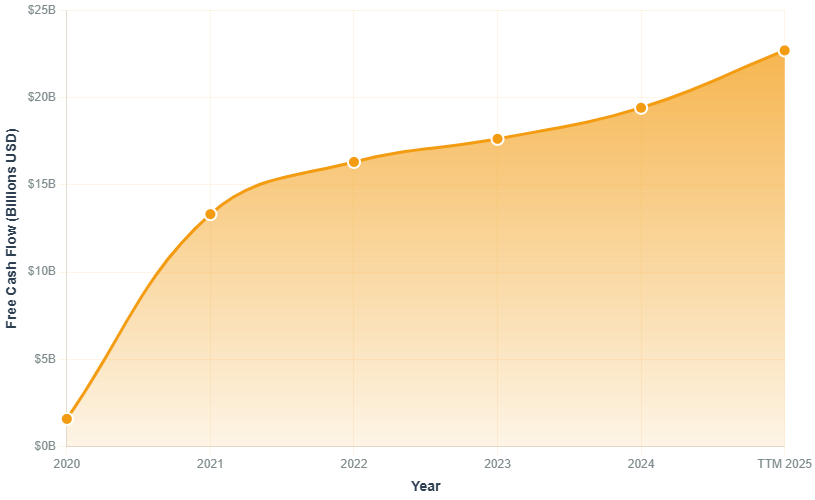

Free Cash Flow:

- Brutal growth, latest year $22.7B

My growth rating: 10/10

- Plus: Growth in all key indicators.

2. Balance Sheet

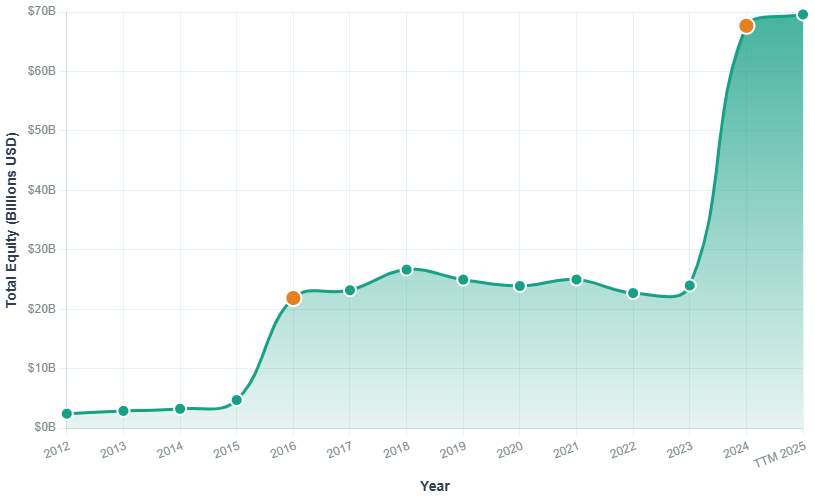

Total Equity:

- Growth from 2.4B (2012) to 69.5B (TTM)

Current Ratio:

- Previously very high (>3), recent years more between 1.08–1.17 (still above 1, so no liquidity issues, but no longer surplus)

Debt/Equity:

- TTM 97%, through most of history under 2x, which is OK for a giant with reliable cash flow

Net Debt/EBITDA:

- Most years around 1–2, completely safe for such a company

Balance sheet rating: 9/10

- Plus: Capital and cash flow, debt under control.

- Minus: Current ratio no longer “super safe” (but no financing issues yet).

3. Profitability

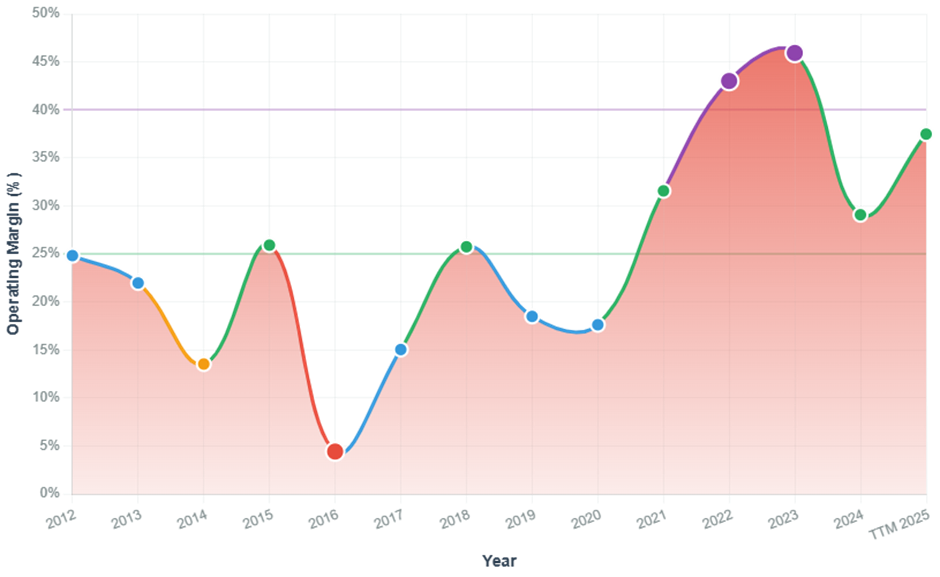

Operating Margin:

- 2012: 24.8%, recent years 30–45%, record high for semiconductors

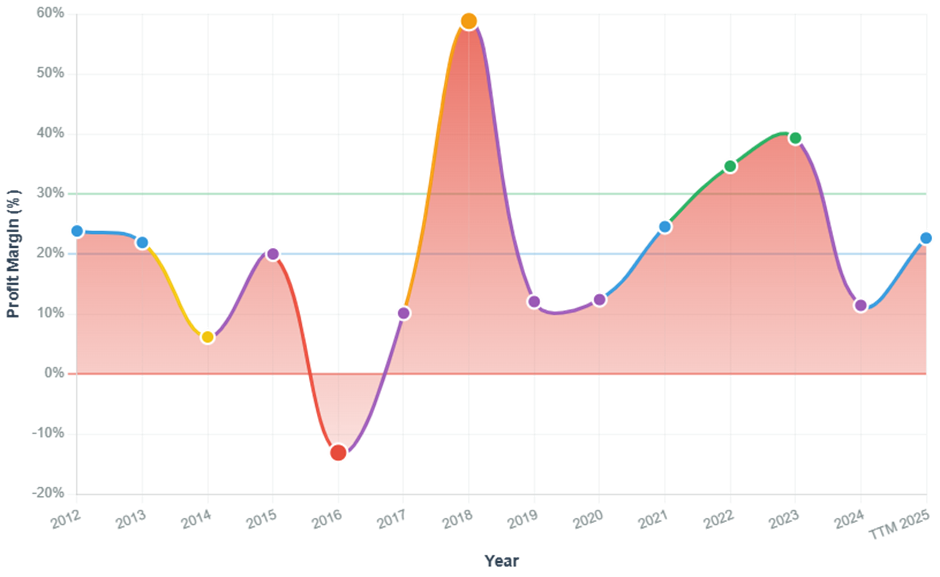

Profit Margin:

- From 23% (2012), to over 30–40% (2022–2024), TTM 22.6%

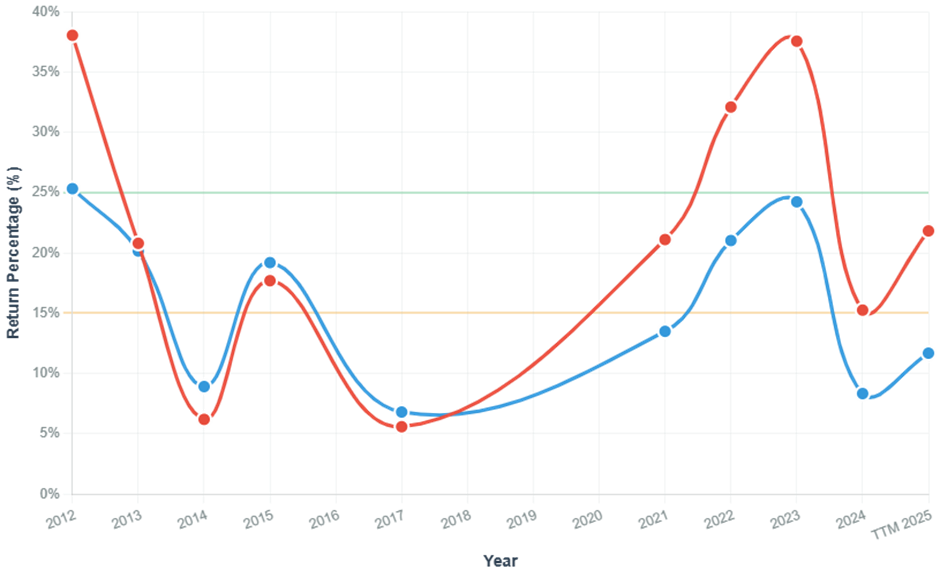

ROE / ROIC:

- ROE between 20–38%, recent years also above 30% (top in industry)

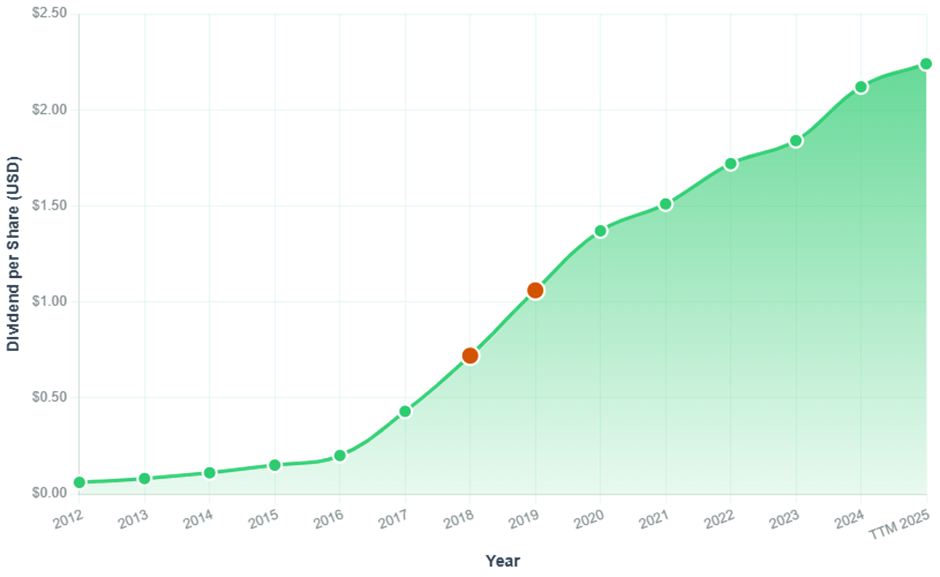

Dividend per Share:

- Steadily growing, consistently higher payouts in recent years

Stock-based compensation:

- Higher than some competitors, but not excessive (grows with market cap)

Profitability rating: 10/10

- Plus: Top margins, high return on capital.

- Minus: Lower margins in some M&A years, occasionally higher SBC.

4. Cash Flow

Free Cash Flow:

- Over $22B TTM, FCF yield around 2.6%

- Mostly positive, growing with business growth

Interest Expense:

- Rising, but lower than cash flow – acquisition financing safely covered

Cash flow rating: 9/10

- Plus: Stable, predictable FCF, easily services debt and dividends.

5. Valuation

P/E:

- TTM 69.8 – considerably higher than long-term average (15–35), due to AI hype and recent acquisitions

EV/EBITDA:

- 13–18 in recent years, on the upper end for the industry, but still OK

P/B:

- 3–5, not cheap, but comparable with other giants

Dividend yield:

- Approximately 2% (TTM), growing every year

Valuation rating: 7/10

- Plus: Not excessively expensive for company’s growth and stability.

- Minus: P/E considerably higher due to hype and stock price growth.

Pros, cons and overall rating

Pros:

- Exceptional growth, record revenues and profits

- Great balance sheet, debt under control

- High profitability, excellent ROE/ROIC

- Stable, growing cash flow, consistently higher dividends

- Reliable “compounder” in portfolio

Cons:

- Currently P/E higher than long-term average (some “AI bubble” effect)

- Current ratio no longer “super safe”, but not problematic

- Rising debt due to acquisitions (but covered by FCF)

Overall rating (my system, 1–10): 9.0

Bottom line

AVGO is a textbook example of a quality compounder – stable growth, excellent margins, strong cash flow, dividend aristocrat in the making. Currently not cheap, but for a company of this caliber, this is the usual premium. For me, the company is currently slightly overvalued. I noticed it before, did brief analyses, but precisely because of this premium price, it didn’t make it to my watchlist. Now I’ve added it to my watchlist, which means I’ll check it more frequently. I won’t buy it currently. I would buy it on a potential downward correction. At what price that would be, I can’t say yet. But I’ll let you know when the time to buy approaches.

Remember: This is my personal analysis based on available financial data. Always do your own research, especially regarding any accounting or regulatory concerns.