Here’s an idea on how to find a beaten down stock rather than a beaten down company.

First, let me explain what I mean: a beaten down company is one that’s struggling with growth — and that’s not what I’m looking for. I’m looking for beaten down stocks — companies that are still growing, but whose share price has been knocked down.

The Difference Matters

This distinction is crucial. A beaten down company has fundamental problems – declining revenues, shrinking margins, losing market share. A beaten down stock is a good company that the market has temporarily soured on.

Examples in my portfolio include Novo Nordisk, UnitedHealth, Crocs, Lululemon, and Adobe. These are all solid businesses that have seen their stock prices decline despite continued growth.

The Investment Thesis

What’s the point of this approach? I’m betting that these companies will continue to grow, while their share prices are currently low due to market overreaction — they were overpriced before, and now the pendulum has swung the other way, making them undervalued.

This is more of a medium- to long-term approach, because a company can keep growing, but the stock price may take time to turn back upward. You need patience for this strategy.

The Screening Process

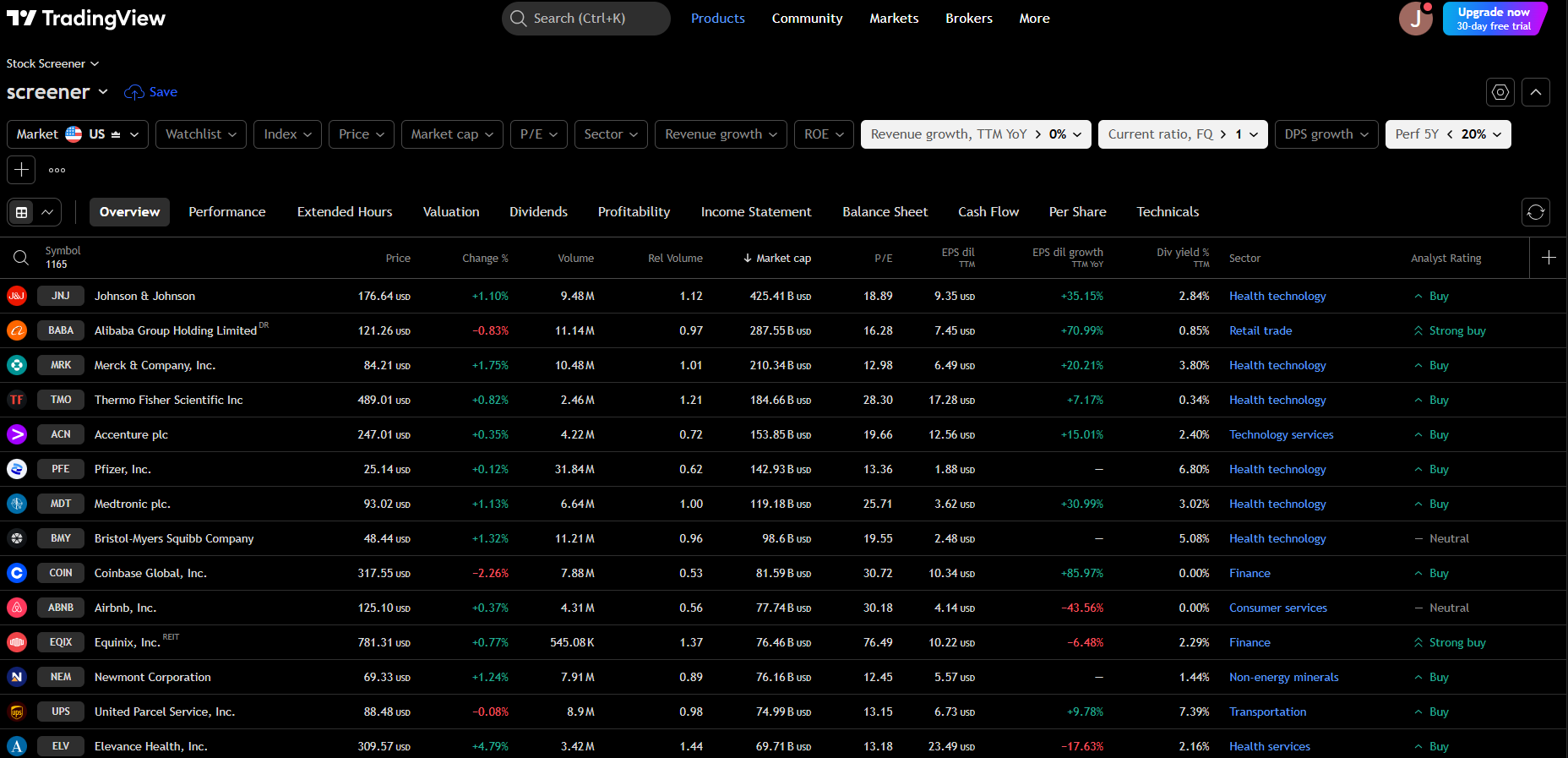

So, how do you filter for such companies? In TradingView, I set the following conditions in the stock screener:

- Current ratio: 1 or higher

- Revenue growth: positive

- 5Y performance: 0% or less, 10% or less, 20% or less, try different levels to see what works for you

Play around with this filter to see what results you get.

Why These Criteria Work

Current ratio above 1: Ensures the company isn’t in financial distress. We want beaten down stocks, not companies on the verge of bankruptcy.

Positive revenue growth: This is key – the business is still growing despite the poor stock performance.

Weak 5-year performance: If it’s a growth company, the stock doesn’t necessarily have to be negative over 5 years — even a gain of just 30% in five years is still relatively weak growth, especially if the business itself is growing fast.

What You’re Looking For

The sweet spot is finding companies where there’s a disconnect between business performance and stock performance. The business is doing well, but investors have lost confidence for temporary reasons – regulatory concerns, short-term headwinds, or simply falling out of favor.

This strategy requires discipline and patience, but it can be highly rewarding when the market eventually recognizes the value in these overlooked growth companies.

Important Disclaimer

This filter doesn’t tell you what to buy and what not to buy. You still need to do proper analysis and consider indicators like P/E ratios, company growth rates, and everything else that goes into investment decisions. This is just a filter to help you find companies that MIGHT be suitable for purchase – the real work starts after the screening.